formcalc calculation with percentage

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Dear all

Just i try to do formcalc....basically GST percentage multiply by Amount and divided by 100....for example my input percentage .15%. not 15%...if i apply like this

$.rawValue = (Row1[*].Cell9)*100

sum ($.rawValue*Row1[*].Cell7/100)

this formula will work only first row....it mean formula will not calculate all rows values. plesae give me some suggestion....thanks for your support.

Views

Replies

Total Likes

![]()

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

The line $.rawValue = (Row1[*].Cell9)*100 makes no sense, what are the brackes for?

If a refered field is in the same row, you don't need to reference the row.

$ = Cell9 * 100

To reference all instances of the field in every row use the sum() method

$ = Sum(Row1[*].Cell9) * 100

To calculate a subtotals use variables.

var SubTotal1 = Sum(Row1[*].Cell9) * 100

var SubTotal2 = Sum(Row1[*].Cell7) * 100

$ = SubTotal1 * SubTotal2

Views

Replies

Total Likes

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Dear radzmar

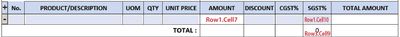

Thanks for your reply, here i attached result screen shot.

which given code is correct. but little modify for percentage formula. please review this code

var SGST = Sum(Row1[*].Cell10) * 100

var Amount = Sum(Row1[*].Cell7)

$ = SGST * Amount / 100

but secount row will not calculate as per this code... this calculate base on first row percentage value.

please review my screen shot.

thanks

Views

Replies

Total Likes

![]()

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Is the second row also named Row1? If not, the script won't work there, since Row1[*] resolves all instances of an element named Row1. In what field do you place the calcuation script?

Views

Replies

Total Likes

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

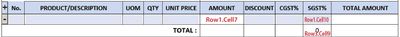

Dear sir, thanks for your reply, for secound row i use form1.main.Table1._Row1.addInstance(true); like this. review my screen shot. script placed in Row3.Cell9 result is also calculate base on first row. please give me suggestion. thanks

Views

Replies

Total Likes

- Mark as New

- Follow

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Views

Replies

Total Likes

Views

Likes

Replies

Views

Likes

Replies