Hyper Personalization in FinTech Ecosystem (Powered by AEP)

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Company Name: NextRow Digital

Company URL: https://www.nextrow.com/

Your Name: Pratheep Arun Raj B (Arun)

Your Title: Enterprise Architect

Describe your company, the customer experience and business challenge(s) you set out to solve with Adobe Experience Cloud products, and how long your company/organization has been using Adobe Experience Cloud products.

Company: NextRow Digital is a new-age digital agency that specializes in marketing cloud and technology implementations. Building the right Digital strategy is key for successful MarTech implementation. Combining over a decade of experience with a flexible and collaborative approach, NextRow Digital helps clients meet their business needs successfully to overcome the challenges of digital transformation.

Customer Experience: BFSI has a complex ecosystem with data security and privacy as paramount factors. In addition to the customer data privacy regulations such as GDPR, CCPA, and PIPEDA, their Internal systems and processes are usually strictly regulated. With these considerations, BFSI is undergoing major changes and disruptions in its ecosystem. Furthermore, providing a unified and real-time experience to the customers remains a challenge for the majority of financial institutions.

Business Challenge: NextRow Digital is set to solve the below business challenges/trends.

- Accelerated Digital Growth

- Multi-Channel Journeys

- Fast-growing Technology

- Unified & Real-time Experience and

- Emerging Competitors

Business Impact: The business challenges had an influence on Customer Experience and opened up the door for 3 key negative impacts.

- No data-driven next-best offers for BFSI products

- High probability of abandonment in a manual muti-step form (BFSI usually have)

- Offline deflection hampers customer acquisition

Describe how you have integrated and used multiple Adobe Experience Cloud products to solve these challenges to improve and personalize the customer experience/journey. Please provide information that will be helpful in understanding your integration (e.g. architecture diagram, step by step process integration flow, etc.).

Getting started: With the aforementioned challenges, NextRow's marketing strategy revolved around the following.

- Relentless Customer Focus

- Omnichannel Execution

- Improve Trust Multi-fold

- Embrace AI/ML Workflows

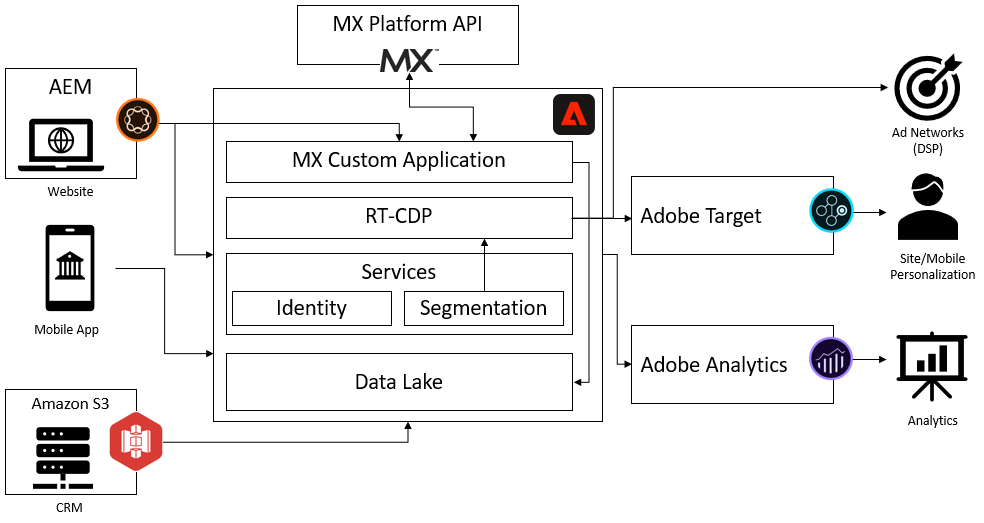

Adobe Experience Cloud Products: NextRow has built an extensive financial services solution powered by Adobe Experience Platform including integrations across Experience Cloud Products below.

- Adobe Experience Platform RT-CDP (AEP RT-CDP)

- Adobe Experience Manager (AEM)

- Adobe Analytics

- Adobe Target

- Amazon Cloud Storage (First-Party Data Source)

- MX Platform API (Second-Party Data Source)

- Adobe Experience Platform Data Collection (Tag Manager)

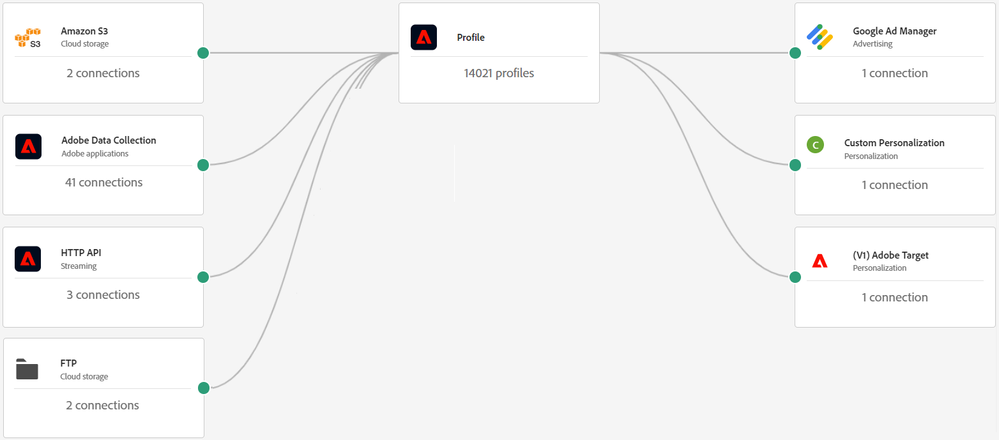

Architecture Diagram: Below is the architecture diagram for the solution.

Steps for Implementation & Integrations: Below are the steps to integrate the solutions.

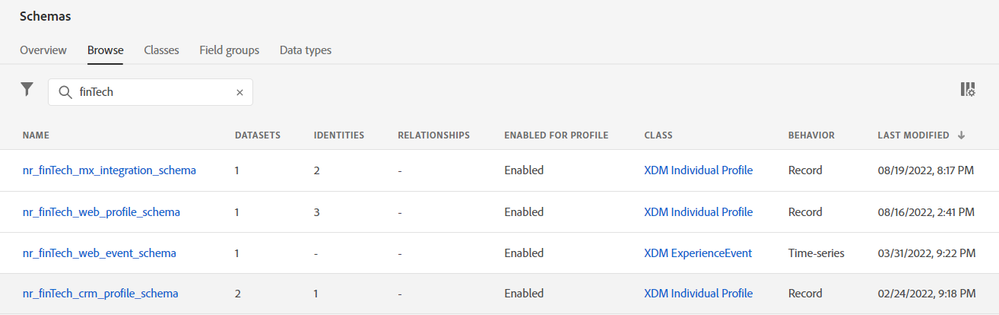

- Create schemas & datasets for the sources. Sources include Website, Mobile App, CRM, and MX Platform API.

- Plan and implement identities for the sources. Sources include Website, Mobile App, CRM, and MX Platform API.

- Implement data collection for the Website using Adobe Launch - AEP Web SDK. This includes setting up properties, creating data streams, enabling experience cloud tools, etc.

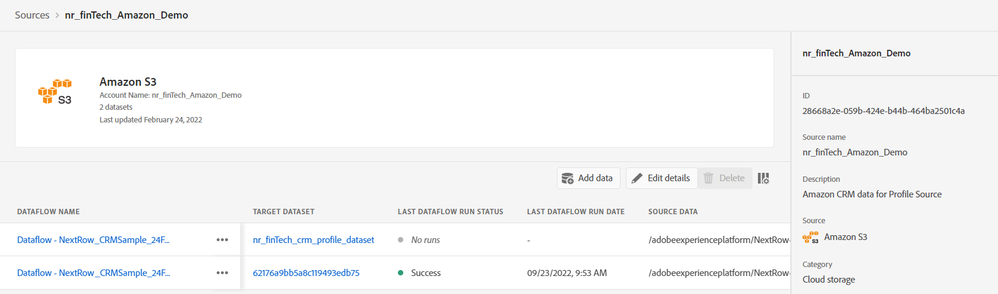

- Connect Amazon S3 using AEP data sources to receive customer details.

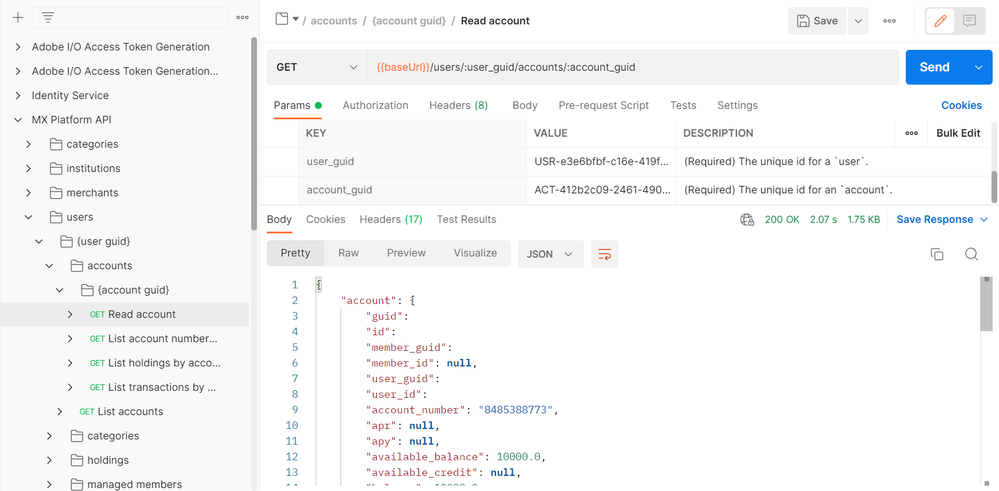

- Build a custom application on top of AEP to integrate MX Platform API to request & receive customer metadata on customer consent.

- Validate the data ingestion for the datasets.

- Enable datasets for Real-time Customer Profiles.

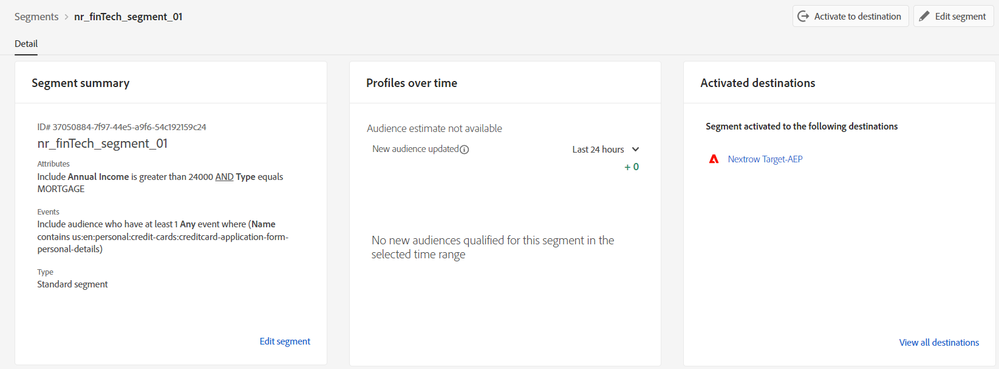

- Create the necessary segments in AEP using Segmentation Service.

- Activate the segments to Target using AEP RT-CDP Destinations.

- Build experiences in Target to deliver personalization on the Website and Mobile App.

- Set up processing rules in Adobe Analytics to receive data from the website.

- Build Adobe Analytics Workspace dashboards to track customer journeys and generate insights.

Screengrabs on Implementation & Integration: Below are some screen grabs on Implementation & Integrations.

AEP Schemas:

AEP Datasets:

Website Implementation (Adobe Launch):

AEP Amazon S3 (Data Source):

AEP MX Platform API (Data Source):

AEP Segment:

AEP Activation:

Based on your successful use and integration of multiple Adobe Experience Cloud products, describe how it has transformed the customer experience/journey, and the value, business impact, and results your company/organization has realized (qualitative and quantitative).

Customer Experience Before Experience Cloud Integration: Typical Credit-Card customer journey looks like the below without Experience Cloud integration.

- Customer lands on the website or mobile application.

- They search/navigate to Credit Card section for exploring the product.

- They reach Credit Card detail pages to understand product benefits.

- They compare Credit Cards using Credit Card Comparator Tool.

- They reach Credit Card multi-step form.

- They complete all the form steps manually.

- Even after they complete the steps, they need to go through the offline profile validation process.

- After submission, they are handled with generic offers.

Customer Experience After Experience Cloud Integration: Enhanced Credit-Card customer journey looks like the below with Experience Cloud integration.

- Customer lands on the website or mobile application.

- They search/navigate to Credit Card section for exploring the product.

- They reach Credit Card detail pages to understand product benefits.

- They compare Credit Cards using Credit Card Comparator Tool.

- They reach Credit Card multi-step form.

- They simply need to complete the required steps since metadata enabled by MX integration can auto-fill multiple steps in real time.

- They receive a recommendation on what’s the best credit card for them based on their web behavioral data from the Comparator Tool, their linked account meta-data from MX, and CRM data from Amazon S3.

- With Credit Score integration, an online credit check for instant approval of credit card was made possible.

- After submission, they are handled with personalized next-best offers powered by the data from website analytics, their linked account meta-data from MX, and CRM data from Amazon S3.

Customer Experience After Experience Cloud Integration (From UI): Below are some screen grabs on Customer Experience from Website Interface.

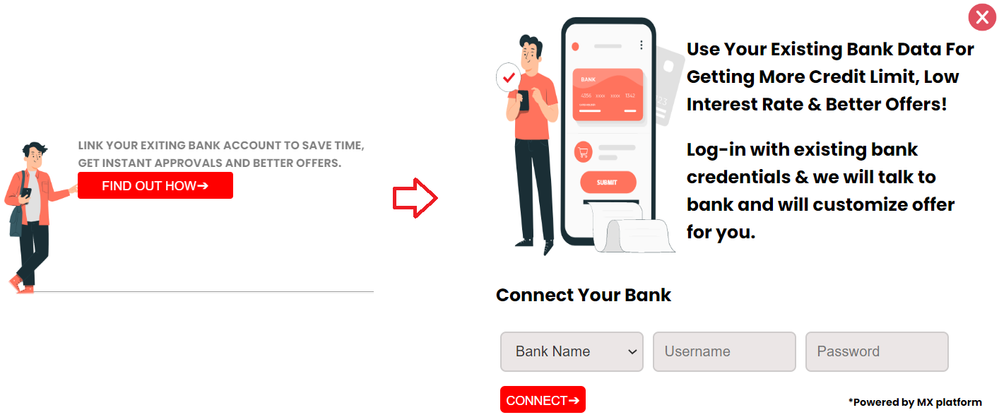

MX Integration Module:

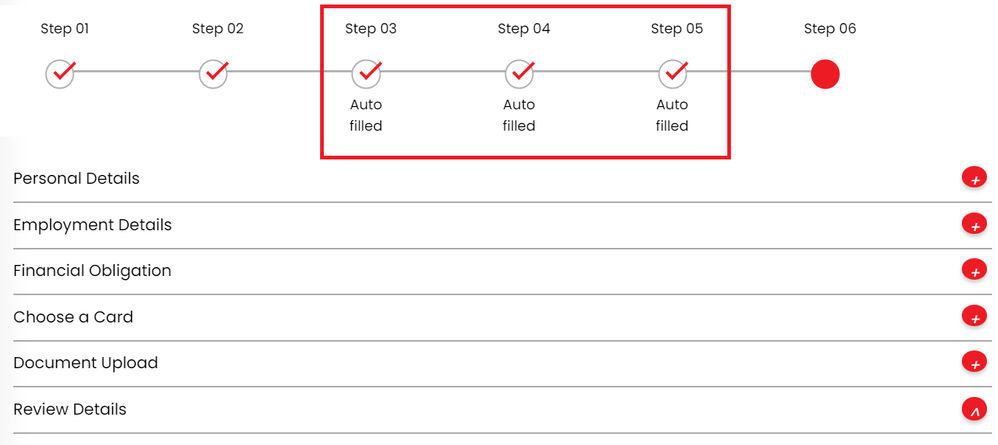

Credit Card Auto-fill Module:

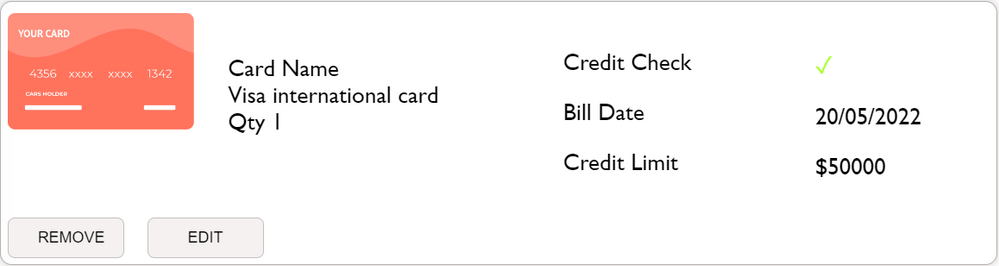

Credit Card Recommendation + Instant Credit Validation Module:

Business Benefits: Below are the solution's benefits and how NextRow has enhanced Customer Experience in BFSI.

- Data-driven next-best offers were provided through multiple integrations

- Less probability of abandonment in an auto-filled muti-step form

- With second-party and credit-check solution integrations, instant approval was facilitated.

Business Results: Solution results are below.

- Increased customer engagements resulting in higher conversion rates and lower drop-off rates.

- Enhanced and personalized customer experience

- Relevant realistic offers based on customer profile & behavior

- Increased customer trust through a high degree of privacy and compliance in a consent-driven approach.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Events

Community

- Community home

- Guidelines

- Community Advisors

- Experience League Showcase

- Advertising

- Analytics

- Audience Manager

- Campaign Classic v7 & Campaign v8

- Campaign Standard

- Developer

- Experience Manager Sites & More

- Experience Platform

- Journey Optimizer

- Target

- Community Announcements

- Real-Time Customer Data Platform

- Workfront

- Marketo Engage

- Commerce

- Creative Cloud

- Document Cloud